Privacy Policy

This Privacy Policy outlines how Then Tax Refunds Ltd. (“we”, “us”, “our”) uses any personal information provided by you when using this website and/or our service(s). It also summarises the measures in place to ensure your personal data is protected. This policy is effective from 01/08/2022, however, may be updated by us in the future by updating this page. It is your responsibility to periodically check this page to ensure you are happy with any changes.

We endeavour to safeguard your personal information and assure you that your information will only be used in a way that you expect, and in compliance with the latest privacy regulations (EU GDPR).

Any of your rights under this policy can not be transferred to any other person. We may transfer our rights under this privacy policy where we reasonably believe your rights will not be affected. If any court or competent authority finds that any provision of this privacy policy (or part of any provision) is invalid, illegal, or unenforceable, that provision or part-provision will, to the extent required, be deemed to be deleted, and the validity and enforceability of the other provisions of this privacy policy will not be affected.

Unless otherwise agreed, no delay, act, or omission by a party in exercising any right or remedy will be deemed a waiver of that, or any other, right or remedy.

This Agreement will be governed by and interpreted according to the law of England and Wales. All disputes arising under the Agreement will be subject to the exclusive jurisdiction of the English and Welsh courts.

Any information provided by you to us, or by a third party with your consent, is referenced in this Policy as “Customer Data” and is controlled and managed by Then Tax Refunds Ltd. When using our service(s) and/or website we may collect information in order to provide our service(s) more effectively including but not limited to:

• Name

• Address

• Contact Information

• Date of Birth

• National Insurance Number

• Employment Information

• IP Address

• Device/Browser Information

• Financial Information

• Payment Details

The above list is not definitive and other information may be required in order to provide our service(s).

Any information requested will only be what is necessary in order to carry out our service(s) or answer a specific enquiry. We may keep a record of any correspondence sent and received by us, both electronic and postal, and also copies of any call recordings if you have contacted us via phone.

Information collected may also be used to provide future services to you.

We may also use software tools to gain insight into how our website and/or service(s) are used. This may include collecting session information, page interaction information, response times and length of page visits.

Other information may be required in order to carry out our services such as:

• Claim Information relating to the nature of your tax claim.

• Employment Information. This may include information on whether you are self-employed, and your income information from the tax year(s) you are claiming for.

• Third party data. This may include information from our selected data suppliers, our regulators, partners or other third parties that we are required to use in order to provide our service(s) to you.

• Information required to provide alternative or future services to you.

Your information may be used to provide and/or improve our service(s). Any information we hold about you will be used only for the purpose for which it was provided. We may also use your tax claim data to identify other services we believe may be in your interest. This includes but is not limited to:

• Data analysis to improve our services.

• Communications sent to you in relation to your queries, administrative updates on your claim, service notifications, offers, billing and other services that may be in your interest.

• Important communications and notices in relation to security or fraud advice. Please note, these communications are required under current legislation and cannot be “opted-out” of.

• Your information may be passed to third parties for the progression or completion of our services.

• Communications sent to you about products and services from third parties that we deem to be of interest to you.

As a client of Then Tax Refunds Ltd., you have the right to opt in and opt out of our service(s). To update your opt-in information, you can do so by emailing data@then.tax. You also have a right to:

• Know how your data is processed and what data is held.

• Access your data.

• Correct any inaccurate information we hold.

• Request erasure of your data.

• Object to or restrict processing of your data.

If you have any concerns about how your information is processed or wish to raise a complaint about our data practices, please contact our Data Protection Officer (DPO) in the first instance. If our DPO is unable to resolve your query, you have the right to raise the matter with the Information Commissioner’s Office (ICO). Further information on the ICO can be found at their website https://ico.org.uk/

The data collected to provide our service(s) will be retained for no longer than necessary. Any data will be held securely in electronic archives for no longer than 6 years after the conclusion of our service(s).

If you communicate with us, we may share the subject matter of your communication(s) with any third parties if we are required to do so to fulfil our service(s) to you.

We will take steps to ensure where possible that access to your data is restricted so that you will not be identifiable. This may not be applicable if access to your data is required by law or is subject to a Subject Access Request (SAR).

Then Tax Refunds Ltd. are committed to ensuring that any data we store is kept secure. We have procedures and policies in place to prevent any unauthorised access, loss, misuse, or disclosure of your personal information. If you are required to enter a password to access our website or any application(s) provided by us, you are solely responsible for password confidentiality. We will not be held liable if unauthorised access to your personal data is gained through the use of your password.

If you use any links to other websites from our website, please ensure you check the Privacy Policy of the website you are visiting. We will not be held liable for any personal information you provide on other websites that are out of Then Tax Refunds Ltd’s control.

Your personal data may be shared or disclosed with other parties if:

· We are required to comply with any legal obligation.

· We are required to exchange information in relation to fraud protection and/or credit risk reduction.

· We merge with/acquire another business.

· Our assets are acquired by a third party.

· If necessary under the Then Tax Group structure.

· If necessary for the progression of your claim(s).

Then Tax Refunds Ltd may, at its sole discretion, update this privacy policy from time to time. When we do so, you will be notified of such and directed to a copy of the updated privacy policy. We would advise data subjects to check this page for any changes to stay informed about how we are helping to protect the personal information we collect. You acknowledge and agree that it is your responsibility to review this privacy policy periodically and make yourself aware of any updates.

Cookies are small text files that are downloaded to your device or computer when you browse a website. They are made up of letters and numbers that allow a website to recognise your device or computer. They are also used to increase user friendliness by remembering website settings and preferences.

Then.Tax uses Cookies for purposes such as:

· Saving your website preferences

· Providing a service

· Monitoring how you use our website and analyse our website performance to make improvements

· For security and fraud protection based purposes

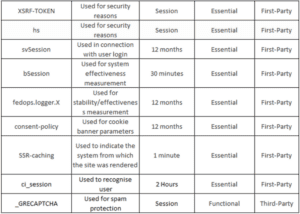

Cookies can be categorised into two different types: First-party Cookies and Third-party Cookies. First-party Cookies are Cookies used solely by Then Tax Refunds for the purposes stated in the above section. Third-party Cookies are Cookies used by third-party companies that are associated with our website. This can include, for example, third-party apps used on our website. Any third-party Cookies cannot be accessed by Then Tax Refunds and likewise any first-party Cookies used by Then Tax Refunds cannot be accessed by any third parties. Specific information about the Cookies Then Tax Refunds and other third parties used on our website, please refer to the Specific Cookies Info section below.

Cookies have varying duration lengths depending on their purpose. A Session Cookie will expire once your browser is closed. Your browser will automatically delete these Cookies upon closure, whilst a Persistent Cookie will remain on your device or computer until the Cookie has surpassed its specified expiry time.

1. Essential Cookies – These Cookies enable core functionality such as security, verification of identity and network management. These Cookies can’t be disabled.

2. Marketing Cookies – These Cookies are used to track advertising effectiveness to provide a more relevant service and deliver better ads to suit your interests.

3. Functional Cookies – These Cookies collect data to remember choices users make to improve and give a more personalised experience.

4. Analytic Cookies – These Cookies help us to understand how visitors interact with our website, discover errors and provide a better overall analytics.

You may change your Cookie settings using the “Settings” option on our Cookie banner. This allows you disable specific Cookie types or to disable all apart from Essential Cookies. You can also find more information about disabling Cookies through a specific browser by checking out your browsers support website.